Condo Insurance in and around Livingston

Welcome, condo unitowners of Livingston

Condo insurance that helps you check all the boxes

There’s No Place Like Home

Because your unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or weight of sleet. That's why State Farm offers coverage options that may be able to help protect your most personal possessions.

Welcome, condo unitowners of Livingston

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

You can rest assured with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with fantastic coverage that's right for you. State Farm agent Christopher Scott can help you discover all the options, from replacement costs, liability to possible discounts.

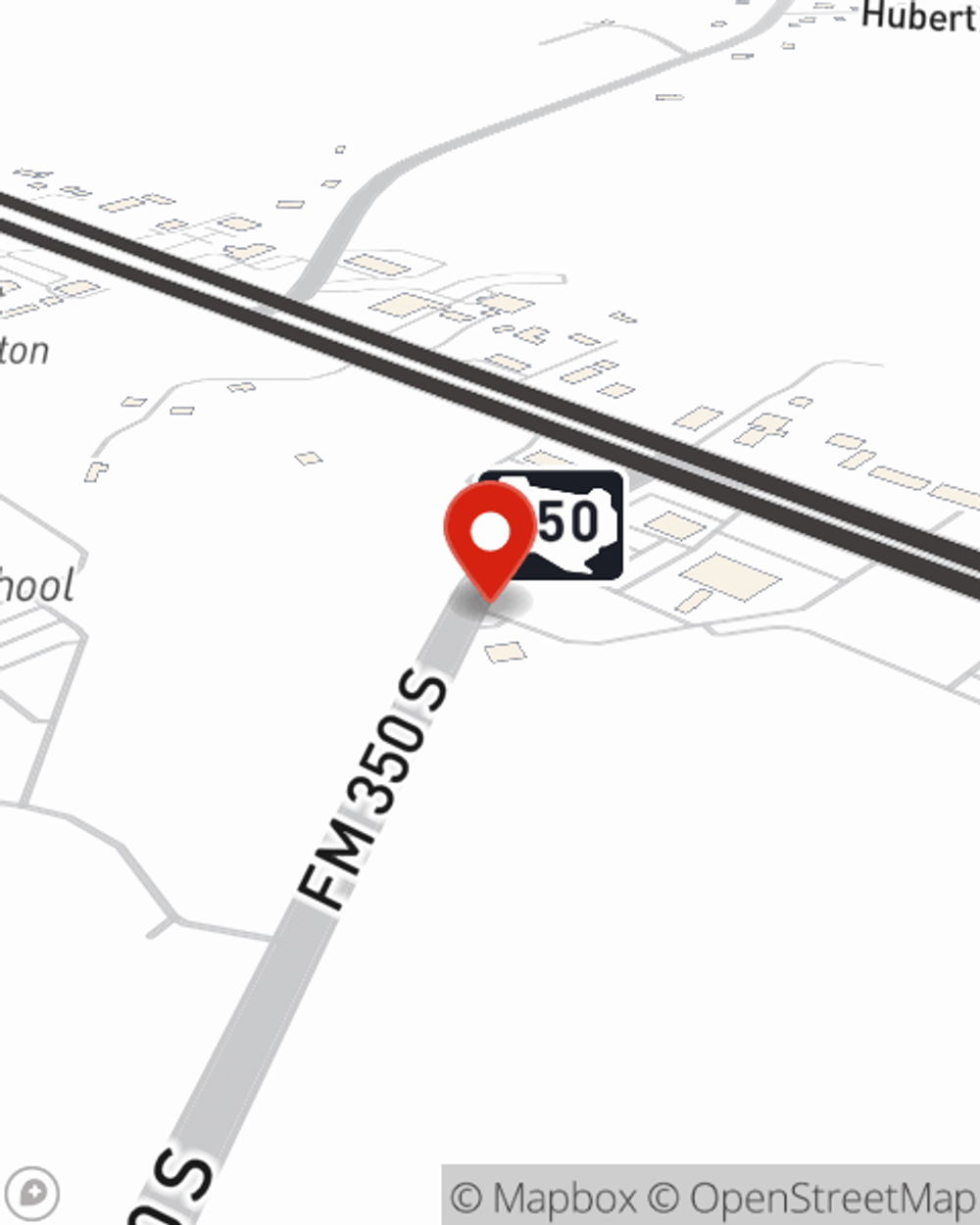

Get in touch with State Farm Agent Christopher Scott today to learn more about how a State Farm policy can help protect your townhome here in Livingston, TX.

Have More Questions About Condo Unitowners Insurance?

Call Christopher at (936) 327-4141 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Christopher Scott

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.